What Home Improvement Projects Fall Under Capital Expenses?

As we approach Tax Day, you may be wondering: What home improvement projects fall under capital expenses?

Home improvement projects considered capital expenses typically involve substantial investments in the property and result in an increase in its value, longevity, or functionality.

Here are some examples:

Renovating or Remodeling: Major renovations or remodels that significantly enhance the property's value, such as adding an additional room, remodeling the kitchen or bathroom, or finishing a basement.- Adding Extensions: Building an extension to increase living space, such as adding a sunroom, a garage, or expanding the square footage of the house.

- Structural Repairs: Repairing or replacing structural components of the house, such as the roof (🏠💪🏻), foundation, or major structural walls.

- Energy Efficiency Improvements: Making energy-efficient upgrades, such as installing energy-efficient windows (👀), insulation, or upgrading to high-efficiency appliances.

It's essential to consult with a tax professional or accountant to determine whether specific home improvement projects qualify as capital expenses for tax purposes, as the criteria can vary based on location and individual circumstances.

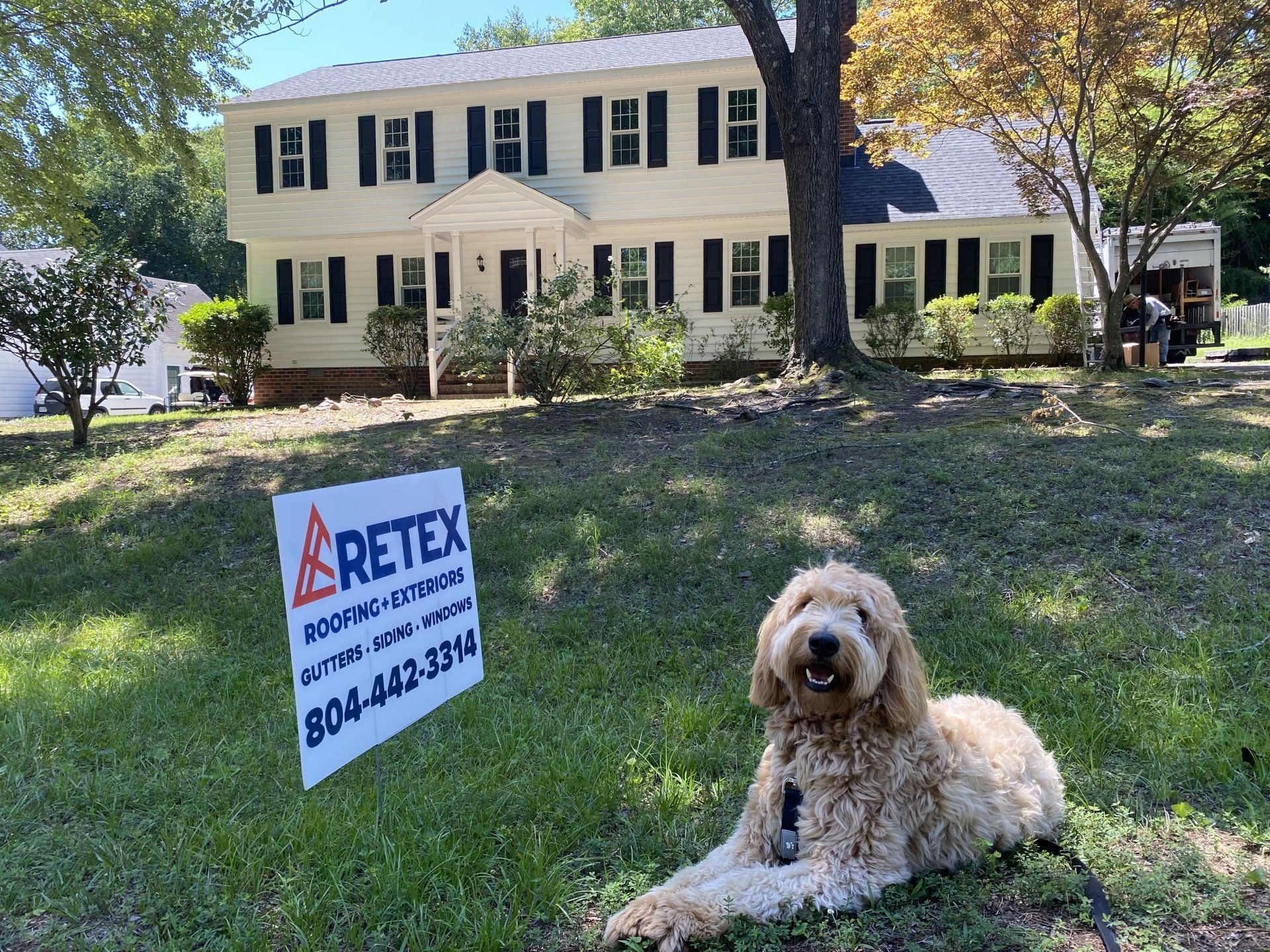

If you’re local to Richmond, Retex is here to help. We provide complimentary roof inspections for storm damage, repairs, and replacements. Call us at 804-258-6300 to schedule your appointment today.